Math vs. Magic: will data finally crack marketing efficiency?

The trillion dollar lament faces a new generation of startups

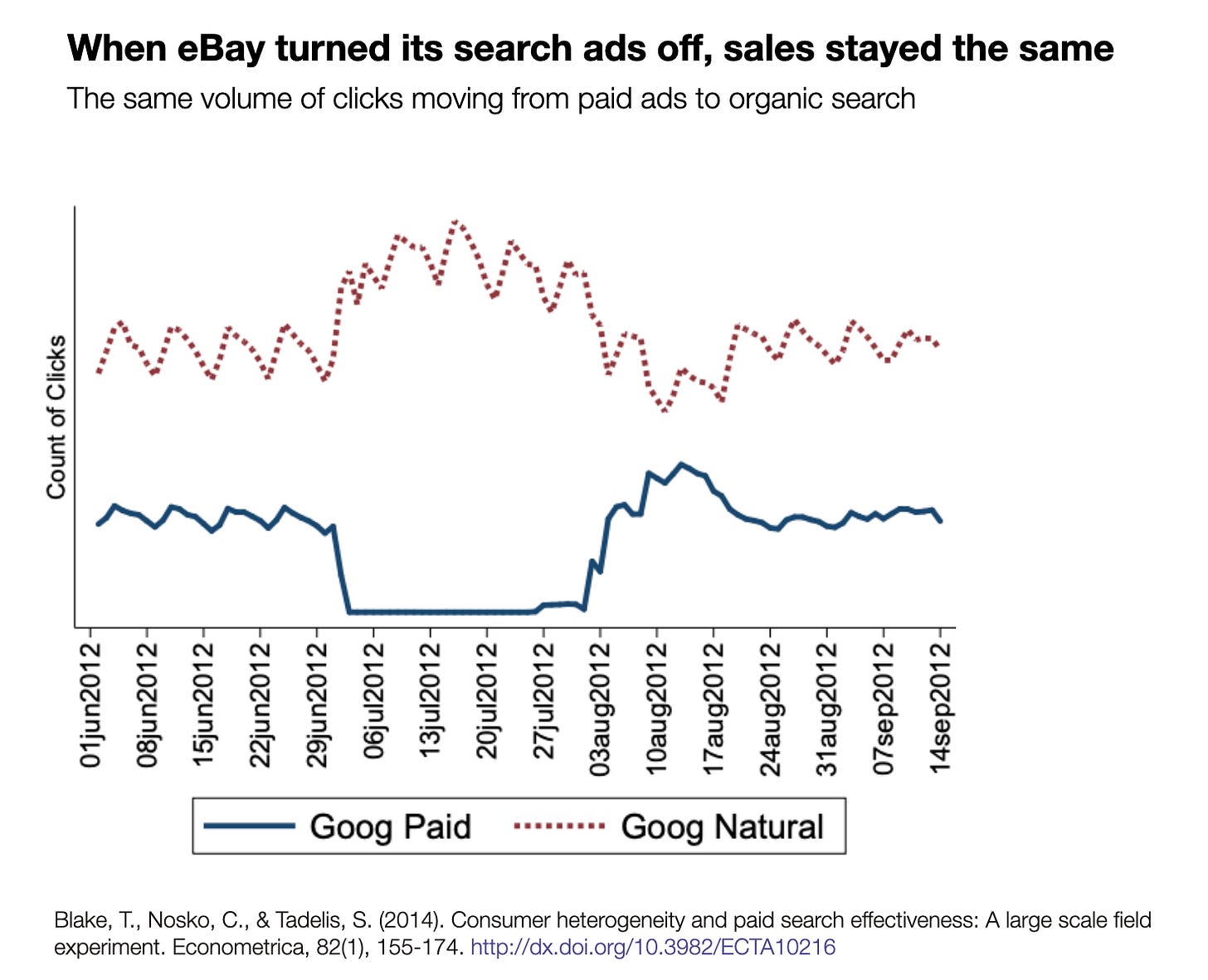

In the summer of 2012, three eBay data scientists convinced management to do something radical: shut off their large Google search advertising for “ebay”-related keywords in a third of their markets in the US. When they got the results back, they found out that eBay’s sales didn’t change at all. Momentum, relationships, and fear of losing competitive positioning had kept a program going that turned out to be a complete waste of money.

Around the world, companies will spend literally a trillion dollars on advertising this year, or about 1% of world GDP. Despite these staggering amounts, the industry still grapples with John Wanamaker's famous lament from the 1910s: 'Half the money I spend on advertising is wasted; the trouble is I don't know which half.' More than ten years after eBay’s experiment and a century after Wanamaker’s quote, things are finally changing. The use of statistics for modeling marketing contributions started as early as the 1960s, but had limited success. It returned to prominence, though, as digital-native consumer companies like eBay, Netflix, and Booking.com used it to control marketing spend while growing quickly and to measure changes in their products’ features. The emerging big data technology landscape supplied the data needed to set up and measure these efforts.

I got interested in this area while working on advertising “relevance” at Chartboost, a mobile marketing advertising network where outcomes could be measured precisely. Later, while building Tech for Campaigns, I discovered that while budgets were huge and the stakes never higher, political advertising was by and large unmeasured. Cambridge Analytica, this was not. Making sense of political advertising was hard, requiring specialized expertise and dedicated funding, and as I learned more, saw that my experience at Chartboost was an outlier, and most advertisers outside of the mobile app world had very limited visibility. This remains the case.

Market size and emerging sustained advantage

Recently, startups have begun to monetize this opportunity outside of hyperscale tech companies. As this work expands from customized in-house teams to standardized products, it’s becoming clearer that these problems are not one-size-fits-all. E-commerce doesn’t easily swap out for retail. A search for truth and evidence is up against deep-seated interests, cultures resistant to change, and a hyper-competitive marketplace. Their ability to survive and compete is not certain. If they do, though, fortunes will be made while helping companies adapt to a higher-interest-rate world and finally delivering consumers more effective sales and marketing communications.

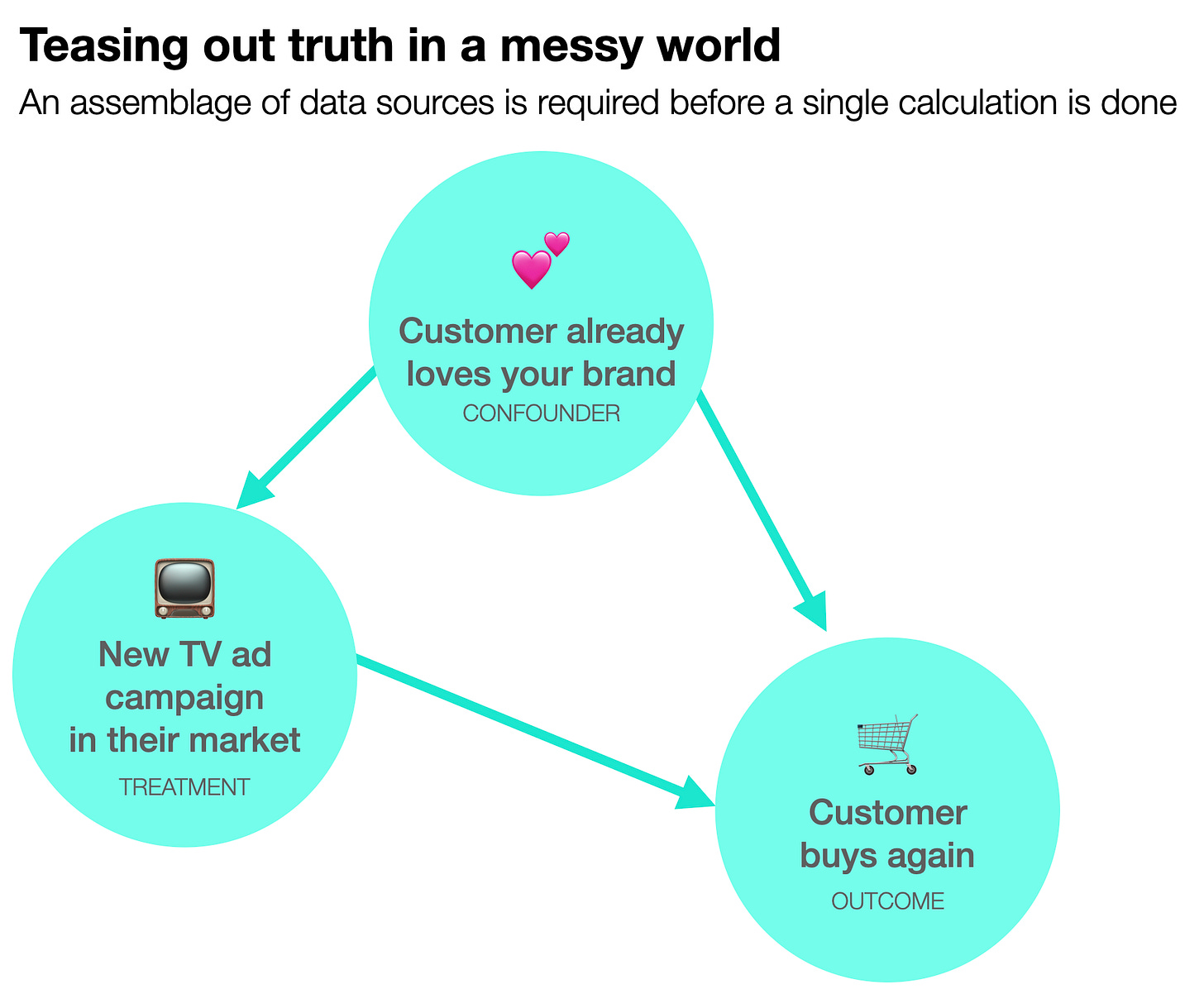

Sales and marketing is a trillion-dollar market and cloud data warehousing, which much of this data sits atop, is estimated by Snowflake to be a $238 billion one. That’s the promise. However, the inefficiencies would not have survived this long if it was easy to access it all. The ability to deliver varies widely across verticals. Let’s take a few examples:

Retail-focused consumer packaged goods. Data comes in big chunks, like store sales data or television ads. Only a bit of individually-named purchase data and can’t directly test ads as cleanly.

eCommerce. Know all their customers by name, but need new ways to test advertising efficacy in a privacy-safe way. Still, they can leverage their website, email, and SMS channels for testing.

Politics. In the US, we have individually-identifiable and reliable data on whether someone voted, but not who they voted for, and only available months after each election.

B2B. Randomized tests are often impractical (airport billboards, anyone?) but it’s clear when prospects and customers engage. Can use in-product experimentation to measure which software features make a difference.

This leaves aside the internal politics of measurement. An analysis may tell the CEO her favorite ad was a dud or tell you to heavily reduce the budget for a valued vendor who’s become a friend. A business crisis may tempt teams into frantic speed, shipping features or marketing campaigns without testing. Not every company will be ready for a more methodological approach.

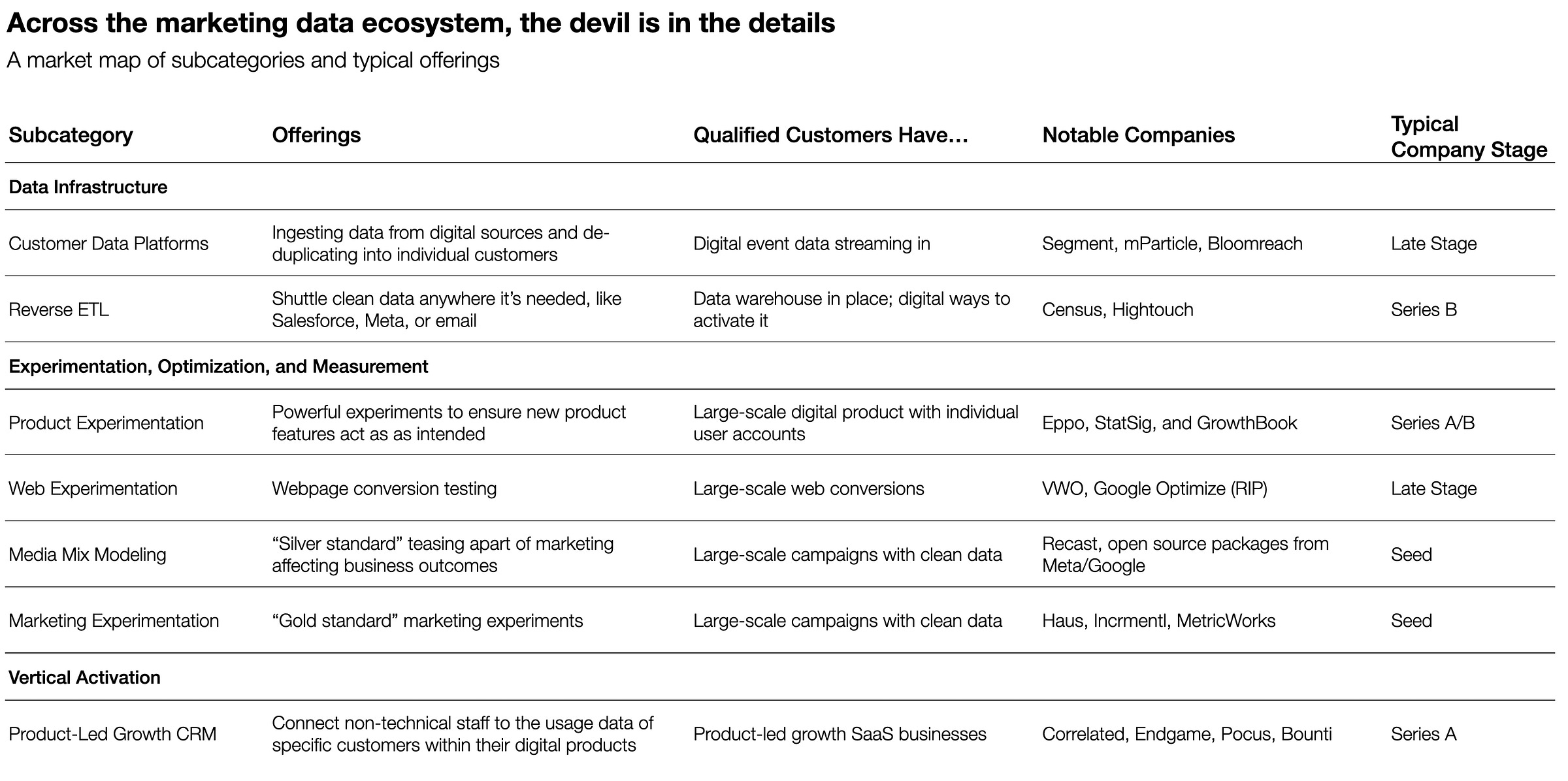

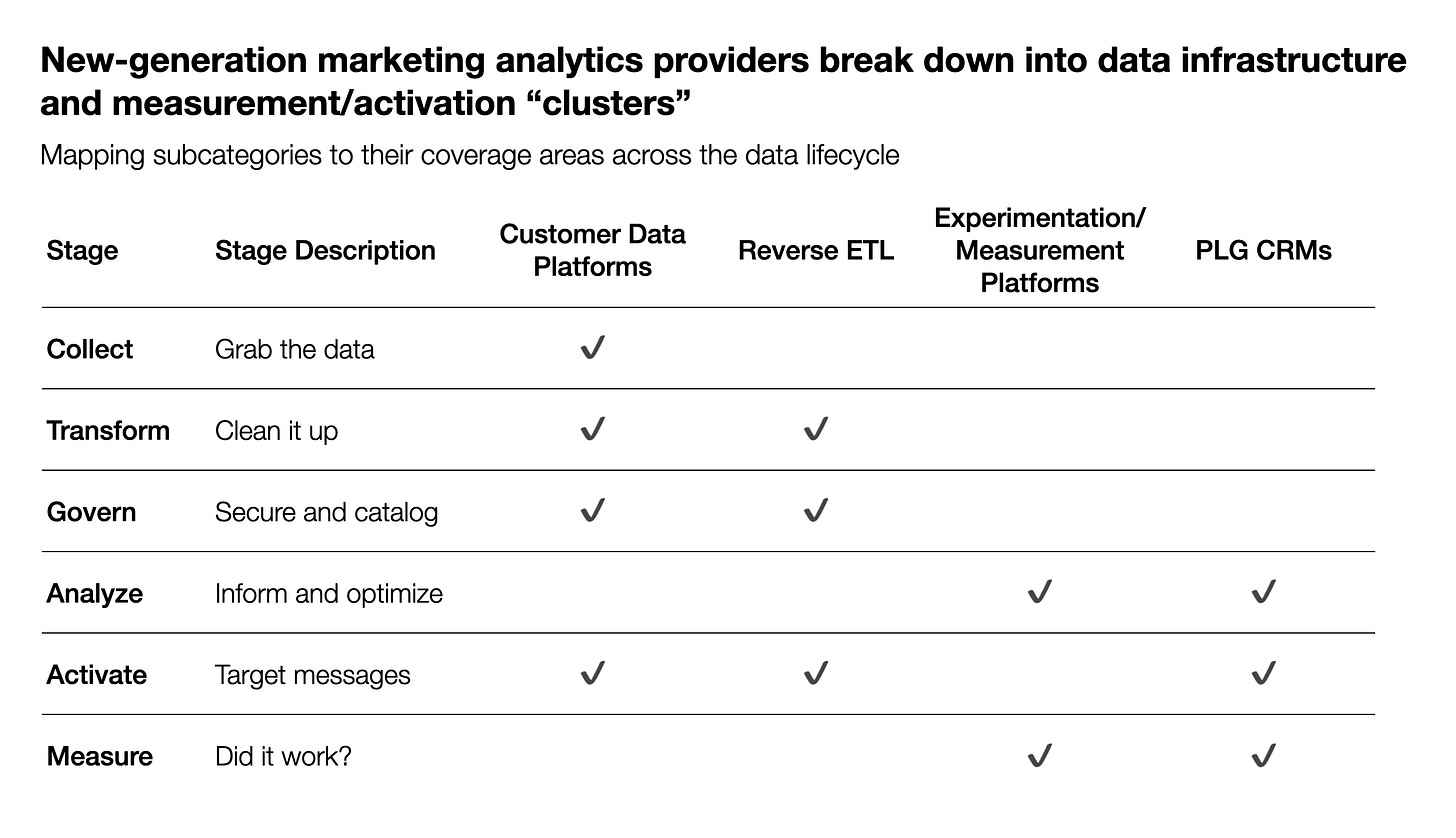

These tools are migrating from big tech to become more accessible, but it’s a dizzying landscape

Here, I’ve grouped examined different subcategories, how they differ from each other, and how they fit into the larger data ecosystem. These categories vary in their popularity and maturity levels, and I’ve excluded established categories like CRM, marketing automation, and attribution. Within these categories, accessing, cleaning, and governing good data is required to actually perform the product experiment, marketing analysis, or sales recommendation, and so while may seem different at first glance, they are closely related.

Sustainable advantage

For these companies to fulfill their opportunities, especially as venture-funded startups, they need to have sustainable long-term profits. Some of these companies are built on known statistical techniques and roll ups of the best practices found within big tech. Is that enough? Hamilton Helmer’s 7 Powers framework (h/t to the Acquired podcast) lists these seven “powers” of competitive advantage:

Scale economies, network effects, counter-positioning, switching costs, branding, cornered resources, and process power.

Stickiness and switching costs stand out, with some room for network effects and process power to evolve as these platforms further connect data to action.

The data infrastructure players like Reverse ETL and Customer Data Platforms (CDPs) are at the center of sales and marketing operations. Their flexibility, reliability in serving clean data, and non-technical user relationships are strategically important as the other categories have to contract to serve specific verticals well. They can continue to add features, serve more clients, and increase value by doing things like creating a partner ecosystem that leverages their flexible and clean data to do sophisticated operations without needing engineering resources.

For measurement startups, earlier in their lifecycle, sustained advantage will require discovery. If they are venture-funded, they may have to expand into adjacent areas, develop network effects through opinionated datasets, or continue developing process power in solving repeated complex client problems. They’ll have to be the tool that drives the machine, bringing more pipelines in house to become the crucial platform. Product-led growth CRMs have a more direct theoretical path: rather than the basic unit of consumer interaction being advertising, within B2B, actions are individually recommendable and trackable. It’s already possible to recommend specific emails and playbooks, then see how they did.

Leveraging the fact that some tools work for specific verticals can become an advantage and develop network effects. Creating anonymized data co-ops across different customers can help make the whole better than the sum of the parts. At Tech for Campaigns, in our Learning Engine data platform, we joined 25+ smaller political campaigns into joining unified marketing experiments. These revealed broader trends that were then activated within each campaign, and would not have been possible individually.

Where this all is going

Systems and processes that clean, enhance, govern, and safeguard corporate data while connecting to key sales and marketing channels and allowing more effective measurement will play dividends across several macro tailwinds:

Greater consumer privacy may decrease the precision and size of the datasets, but increase complexity and compliance demands beyond what most companies want to handle. Shifting away from individual-level event logs towards aggregated usage data with country-specific and industry-specific privacy and compliance requirements could increase the importance of intermediaries that help individual companies navigate the regulatory morass safely and still measure investments clearly.

The promise of generative AI for many industries is clear, but the “pipes” to deliver data to, and retrieve it from, foundation model partners remain to be built out. CDPs and Reverse ETL platforms can make it easy to plug in those stools to analyze customer support traffic, write customized messages at scale, or more.

The end of the zero interest rate era means greater appetite to improve the efficiency of sales and marketing spend. The improving ease of use and availability of marketing measurement and the PLG CRMs will help drive this forward in B2B.

None of these categories are sure bets. They are each taking on considerable technical and cultural hurdles, but it’s an exciting time. As the eBay test showed long ago, the potential is huge. Wanamaker, watch out.